Gift plans create opportunities for both our donors and Camp of the Hills. There are many options from which you can choose. The correct plan for you balances what you wish to accomplish for yourself, your family, and your charitable interests in your overall estate and financial plans. Learn about giving strategies that allow you to make a meaningful charitable gift while possibly enhancing your, and your family’s, future financial well-being. Unless otherwise directed by you, the donor, all planned gifts will be put into the Camp of the Hills Operational Endowment. Listed below are some of the types of assets donors may contribute to Camp of the Hills.

Retirement Assets

A gift of your retirement assets [IRA, 401(k), 403(b), pension or other tax deferred plan] is an excellent way to make a gift. By making a gift of your retirement assets, you will help further our work. Give your retirement assets in your will Did you know that 50%-60% of your retirement assets may be taxed if you leave them to your heirs at your death? Another option is to leave your heirs assets that receive a step up in basis (such as real estate and stock) and give the retirement assets to our organization. As a charity, we are not taxed upon receiving an IRA or other retirement plan assets. How to transfer your retirement assets Your retirement assets may be transferred to us by completing a beneficiary designation form provided by your plan custodian. If you designate our organization as beneficiary, we will benefit from the full value of your gift because your IRA assets will not be taxed at your death. Your estate will benefit from an estate tax charitable deduction for the gift.

Additional methods of giving

Real Property

Business Interests

(non-publicly traded or closely held stock, partnership interests, etc.)

Oil and gas, mineral and timber rights

Estate assets

Trust assets

Tangible personal property

Federal tax ID

74-2614354 • 2016

Have a Question?

Contact our Executive Director, Michael Thames

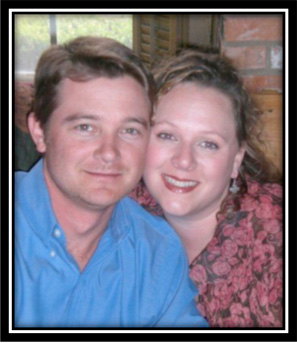

Michael Thames

Executive Director

Michael joined the staff in June 2011 as Development Director. He was a former camp counselor in 1998 & 1999, where he met, fell in love with and got engaged to Cara, the camp nurse. Michael and Cara worked full-time in inner- city ministry for over 10 years and brought children to Camp of the Hills every summer. They have three children, Tristan, Brendan, and Eden. Michael and Cara have a passion for at-risk children and seeing them come to know and be transformed by Jesus.